Using the right personal finance tool or application can make managing your money so much easier. Quicken is a name that has been around in the finance software industry for ages – but has it been able to stay relevant? Let’s take a look at some of the details and what I’ve found using the software for the last little while.

Quicken History

Quicken was first released in 1983 as one of the biggest personal finance management programs. It gained popularity for it’s user-friendly interface and powerful features that helped individuals and small businesses manage their finances, track expenses, create budgets, and plan for the future. It’s undergone numerous updates and enhancements over the years, but faces a lot of stiff competition these days.

While Quicken continues to be a reliable tool, the personal finance software market has diversified, with other platforms offering specialized features that may better suit specific financial management needs. Therefore, the “best” software often depends on individual requirements, such as budget tracking, investment management, or expense tracking.

Why I’ve Switched to Quicken

As a personal finance enthusiast, I’ve tried a lot of different tools over the years. Between use of Mint, YNAB and plain-old Excel, I ended up finding that Excel provided the customization I needed to manage my own financial circumstances. This wasn’t great because while Excel is very powerful, setting everything up manually, creating your own formulas and integrating different accounts becomes very tedious and cumbersome. But Mint and YNAB didn’t provide me all the tools I needed in one place.

With starting my own business in recent months that is intertwined with my personal finances, I wanted a solution that could help me manage everything in one place without having to implement complicated customization for every aspect in Excel. That’s when I decided to try the Canadian version of Quicken to see if it could satisfy all my needs.

Required Uses

When it comes to finance software that I was looking to use, I needed to be able to do the following:

- Download credit card and bank transactions and be able to categorize and classify them.

- Keep a running tally of expenses that are split with my partner

- Track and classify business income and expenses in and out of my accounts.

- Create personal and business budgets to manage all of my expenses.

From reading about Quicken, it seemed to be able to do all of these things, so I decided to give it a try given that it has a 30 day money back guarantee.

Purchase and Installation

I got off to a bad start right off the bat. I purchased Quicken Personal and Small Business off their website, without realizing I was purchasing the American version. Immediately I couldn’t integrate with any of my bank accounts and I could tell that something was up. I had to get a refund and be redirected to the small Canadian section of their website with a download for their Canadian product. Contacting Quicken support, they processed my refund very quickly, and I purchased the Canadian version and was off and running. It really should have been more clear on the website which version of the software I needed to purchase, and is an example of Quicken’s old school mentality of not being optimized for having multiple versions of their software.

Interface and UI

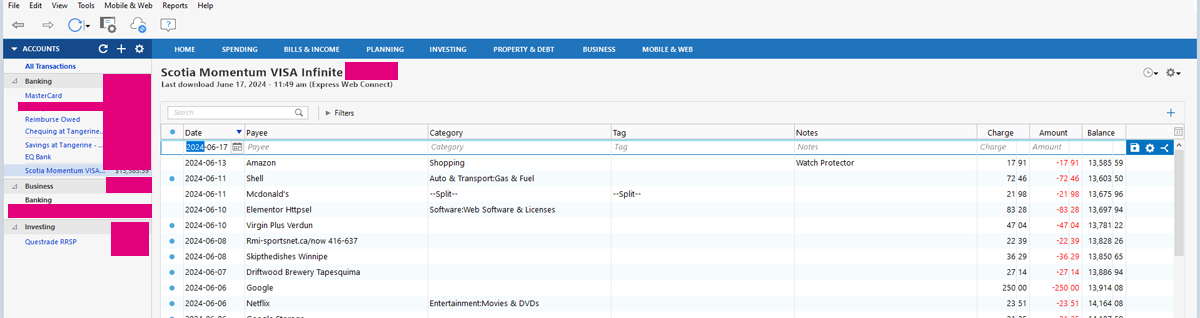

As soon as I loaded up Quicken, I could tell why it has lost a bit of it’s relevancy lately. The UI is a little old fashioned looking and while it has companion web apps and mobile apps, Quicken Personal and Business is a desktop based application. I don’t mind that as I spend a lot of time on my business PC, but many will expect to have a totally browser based application that can be used strictly on their phone or tablet if needed.

Setup

Getting setup with Quicken was both easy and hard. It was easy to add multiple banks accounts, credit cards and investment accounts to be able to categorize and separate transactions. And while Quicken Classic Business and Personal was able to download transactions from my credit card account automatically, it couldn’t do the same for my bank accounts with Tangerine, or my investment account with Questrade.

It does allow for the export of import of transactions from Tangerine though, so this didn’t have too much of an impact on me.

What isn’t necessarily intuitive with Quicken is setting up categories properly. I took me a while to figure out how to classify a category as a business transaction instead of a personal transaction (I needed to specify a tax type for the transaction), but I needed to look up a guide to find out how to do that. In my opinion the application should be simple enough for me to figure out to do that on my own.

Data Organization

As with starting with most personal finance applications, you’ll have to spend some time manually categorizing purchases to teach the program how your transactions fit with your categories and habits. It’s an annoying thing to do, but hard to avoid with any application. As smart as they are when trying to guess your categories, there is always something wrong, and mis categorizing transactions can cause major headaches when producing reports and overviews of your finances.

Separating Business and Personal

One of the more important aspects of Quicken for me is separating my business and personal transactions. After I determined how to make business categories (as mentioned above) Quicken makes it quite easy to separate out your transactions, and get reports for your personal budget or your business budget.

The software also makes it easy to budget for both personal and business expenses, and toggle between both of them very easily.

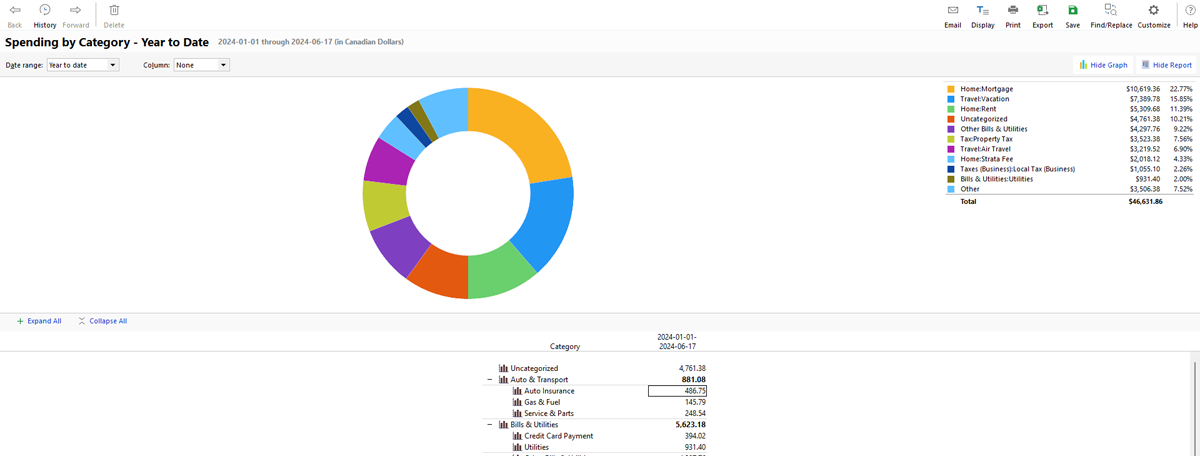

Reporting and Graphing

This was one of the major functionalities that I was excited for when moving away from my own Excel spreadsheets into the more robust software solution. Quicken has a ton of built in reports that can produce all sorts of stats and graphs. The one thing that should be noted here is that your data needs to be clean – it will take a while to go through all of your old data to make sure that it is categorized correctly with Quicken so that Quicken can produce accurate reports.

So is it still relevant?

This is a tough question. For me, I’ve found being able to use Quicken incredibly useful as I have a lot of niche functionality that I’m looking for that Quicken is able to provide. But it does take a lot of time to classify your data accurately and setup your accounts properly. For those looking for an easy budgeting tool, this may not be for you. But for those looking to really customize how they manage their money and their small business, Quicken, at about $120 CAD per year, might be the exact tool that you are looking for!